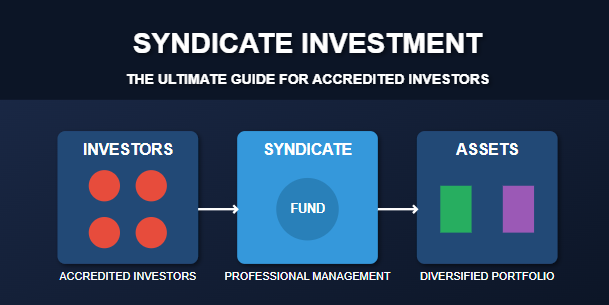

For accredited investors seeking to diversify their portfolios beyond traditional stocks and bonds, syndicate investments offer a compelling avenue to access deals previously reserved for institutional investors. This powerful investment approach allows individuals to pool resources, share risk, and gain access to premium opportunities across real estate, startup equity, and other alternative asset classes.

What Is a Syndicate Investment?

A syndicate investment is a partnership structure where multiple investors combine their capital to participate in an investment opportunity that might otherwise be inaccessible to individual investors. This collaborative approach is led by a sponsor or syndicator who identifies opportunities, conducts due diligence, structures the deal, and manages the investment.

According to the Securities and Exchange Commission, syndications typically operate under Regulation D exemptions, which allow companies to raise capital without registering with the SEC, provided they meet certain requirements, including limiting participation to accredited investors.

Why Syndicate Investments Are Gaining Popularity

Syndicate investing has experienced significant growth in recent years for several compelling reasons:

1. Access to Premium Opportunities

Syndicates provide accredited investors access to institutional-quality investments across various asset classes that would typically be out of reach for individual investors due to high minimum investment thresholds.

2. Professional Management

Syndicates are typically led by experienced operators with specialized expertise in their particular asset class, providing professional oversight that individual investors might not possess.

3. Diversification Benefits

As noted by McKinsey & Company in their private markets research, alternative investments like those accessed through syndicates can provide valuable portfolio diversification given their generally lower correlation with public markets.

4. Reduced Administrative Burden

Syndicate sponsors handle the complex administrative aspects of investments, including legal documentation, property management (in real estate), and investor communications.

5. Risk Mitigation

By pooling resources, investors can participate in multiple deals across different geographies, asset types, and risk profiles, potentially mitigating concentration risk.

Common Types of Syndicate Investments

While syndication structures can be applied across numerous investment categories, several have emerged as particularly popular among accredited investors:

Real Estate Syndicates

Real estate remains one of the most common syndicate investment vehicles. These structures typically focus on:

- Multifamily Properties: Apartment complexes offering stable cash flow and appreciation potential

- Commercial Real Estate: Office buildings, retail centers, and industrial properties

- Development Projects: Ground-up construction of residential or commercial properties

- Specialized Assets: Self-storage facilities, mobile home parks, and other niche property types

According to National Real Estate Investor, real estate syndications have democratized access to institutional-quality properties, allowing accredited investors to participate in deals that would previously have been limited to REITs and large institutions.

Angel Syndicates

Angel syndicates pool investor capital to back early-stage startups. These are often organized through platforms like AngelList, which reports facilitating billions in startup investments through its syndicate structure.

Key features include:

- Lead Investors: Experienced angels who source deals and conduct initial due diligence

- Deal-by-Deal Participation: Flexibility to opt in or out of specific opportunities

- Portfolio Approach: Ability to spread capital across multiple startups

- Industry Focus: Some syndicates specialize in specific sectors like fintech, biotech, or SaaS

Private Equity and Venture Capital Syndicates

For accredited investors seeking exposure to private companies beyond the earliest stages, private equity and venture capital syndicates offer access to growth-stage and mature private businesses.

As Preqin, a leading alternative assets data provider, notes in their global private equity reports, minimums for direct private equity fund investments often start at $5-10 million, making syndicate vehicles attractive for investors unable to meet such high thresholds.

Structure of Syndicate Investments

The typical syndicate investment follows a similar structure regardless of asset class:

Legal Framework

Most syndicates are structured as Limited Liability Companies (LLCs) or Limited Partnerships (LPs) with:

- General Partner (GP): The sponsor who manages the investment

- Limited Partners (LPs): The passive investors who provide capital

Capital Contribution

Investors contribute a defined amount of capital, with minimums typically ranging from $25,000 to $250,000 depending on the deal size and sponsor.

Profit Distribution

Profits are distributed according to a predetermined waterfall structure, typically including:

- Preferred Return: A priority return to investors (often 6-8%) before the sponsor participates in profits

- Profit Split: After the preferred return, profits are split between investors and the sponsor (common arrangements include 70/30 or 80/20 in favor of investors)

- Promote/Carried Interest: The sponsor's share of profits above the preferred return

Investment Timeline

Most syndicate investments have defined holding periods ranging from:

- 3-5 years for opportunistic investments

- 5-10 years for value-add or core-plus strategies

Advantages for Accredited Investors

Syndicate investments offer several distinct advantages tailored specifically to accredited investors:

Passive Investment Approach

Unlike direct property ownership or business management, syndicate investments are passive, requiring minimal time commitment while still providing access to the benefits of alternative assets.

Specialized Expertise

Syndicates leverage the expertise of sponsors who often have decades of experience in their specific niches—expertise that would be difficult for individual investors to replicate.

Potential Tax Benefits

Depending on the asset class, syndicate investments may offer attractive tax advantages. For example, real estate syndicates often provide:

- Depreciation pass-through

- 1031 exchange potential

- Long-term capital gains treatment

According to The Tax Adviser, these tax benefits can significantly enhance after-tax returns compared to traditional investments.

Aligned Interests

Well-structured syndicates align sponsor and investor interests through:

- Significant sponsor co-investment

- Performance-based compensation

- Reputation-dependent business models

Key Considerations Before Investing

While syndicate investments offer compelling advantages, accredited investors should carefully evaluate several factors:

Sponsor Track Record

The sponsor's experience and historical performance are perhaps the most critical factors in syndicate selection. As Cambridge Associates notes in their private investment research, manager selection in alternative investments has an outsized impact on performance compared to traditional asset classes.

Investment Strategy

Understand the specific strategy and how it fits within your overall portfolio:

- Value-add vs. core vs. opportunistic approaches

- Geographic focus and diversification

- Asset class specialization

- Target returns and risk profile

Fee Structure

Carefully evaluate the fee structure, which typically includes:

- Acquisition Fee: 1-2% of the purchase price

- Asset Management Fee: 1-2% annually

- Disposition Fee: 1% of the sale price

- Promote/Carried Interest: 20-30% of profits above the preferred return

Liquidity Constraints

Most syndicate investments are illiquid for the duration of the holding period. According to Morningstar, investors should generally not allocate more than 15-20% of their overall portfolio to illiquid investments.

How to Get Started with Syndicate Investing

For accredited investors looking to begin investing in syndicates, several pathways exist:

1. Investment Platforms

Online platforms have democratized access to syndicate investments:

- CrowdStreet for commercial real estate

- AngelList for startup investments

- Fundrise for various real estate strategies

- Republic for startup and real estate opportunities

2. Professional Networks

Many syndicate opportunities come through professional networks:

- Industry conferences and events

- Investment clubs

- Professional associations

- Wealth management introductions

3. Direct Sponsor Relationships

Developing relationships with established sponsors can provide access to off-market opportunities not available through platforms.

Due Diligence Best Practices

Thorough due diligence is essential when evaluating syndicate investments:

Sponsor Verification

- Review the sponsor's track record on similar investments

- Verify professional backgrounds and references

- Check for any regulatory issues or litigation

- Evaluate alignment through sponsor co-investment

Deal Analysis

- Independently verify key assumptions

- Review third-party reports (appraisals, market studies)

- Understand the exit strategy

- Assess competitive landscape

Legal Review

Have experienced legal counsel review the offering documents, paying particular attention to:

- Voting rights and control provisions

- Fee structures and potential conflicts

- Distribution waterfalls

- Dispute resolution mechanisms

The Future of Syndicate Investing

The syndicate investment landscape continues to evolve rapidly. Several trends are likely to shape its future:

Increasing Institutionalization

As Pitchbook has documented, family offices and smaller institutions are increasingly participating in syndicate deals alongside individual accredited investors, bringing greater sophistication to the space.

Technology Integration

Investment platforms are leveraging technology to streamline due diligence, reporting, and investment management, making the process more accessible and transparent.

Regulatory Evolution

The SEC continues to evaluate and update regulations around private offerings, potentially expanding access while maintaining investor protections.

Conclusion

For accredited investors seeking diversification beyond traditional markets, syndicate investments offer a compelling combination of professional management, access to institutional-quality assets, and potentially attractive risk-adjusted returns. By pooling resources with other investors under the guidance of experienced sponsors, individuals can participate in opportunities that would otherwise remain inaccessible.

However, successful syndicate investing requires careful due diligence, a clear understanding of the risk-return profile, and patience through typically longer holding periods. With proper evaluation and a disciplined approach to manager selection, syndicate investments can become a valuable component of a sophisticated investor's alternative asset allocation.

Before pursuing any syndicate investment opportunity, accredited investors should consult with their financial advisors to ensure alignment with their overall investment strategy, risk tolerance, and liquidity needs.